The Beginning

The journey began long before, as we toyed with the idea of moving out of the cherished home where we raised our two children. We explored many different ideas as we approached the stage where the mortgage on the house was going to be paid off: #1-obtaining a cottage, #2-downsizing to a patio home, #3-buying a second property down south. I think it’s common as the children grow into adulthood; you begin a journey of your own. Suddenly, that incredible position you held as caretaker, proprietor of all things involving your children changes as they become independent and begin their individual journey.

I entirely enjoyed the position of a stay-at-home mom, raising my two kids. It was the only thing I ever wanted to do. I think that is why I was so discontent when the job came to an end and it was apparent that I had to reinvent my role. I’m still working on that. But, that’s another subject altogether.

There were many factors that eliminated the options we explored:

#1-obtaining a cottage:

We realized the cost of the cottage vs. the amount of days we would be able to enjoy said cottage didn’t add up to being a sound investment. We had already invested in a boat at one time and sold it after several summers where we found we really didn’t have the time to enjoy it as much as we thought we would. We had an in-ground pool at the house and it seemed unlikely that on the few hot days that we would enjoy in Upstate New York that we would want to be at the cottage instead of the pool.

#2-downsizing to a patio home:

As they began to pop up all over we were drawn to the idea of a patio home. We spent many Sunday afternoons touring the model homes and toying with the idea. After we did the math and realized that we’d be making a substantial investment in a newer, yet smaller footprint we scraped the idea altogether. As it was our home was just 2,000 square feet and we really didn’t want to go smaller. What we fantasized was resizing our square feet. There were rooms we didn’t use: like the living room, the finished basement; and areas we desired: a mudroom, a first floor laundry, larger closets, a master bedroom that would accommodate a King-size bed, a larger kitchen and a sunroom.

#3-buying a second property down south:

Like most Northerners, the journey down South during the Winter months is a much appreciated escape. On each journey to a sunny destination, I would explore the real estate available and I spent months researching and dreaming of a property in that area. Adding up the cost of the property, utilities, and HOA fees, factoring in the reality that we would not really be the ability to enjoy the property that often, and considering renting it out and all the hassles that lie within that…we opted out.

So, it began we drew up a Wish List. If we found a property in our area that had all the items on our Wish List; then, we would move. On Christmas Day 2015, I found a quiet moment to peruse my favorite site and scope out the Real Estate listings. I discovered that property. A Christmas Miracle. It was a foreclosure property, on one of our favorite streets. It was a 3,380 square foot

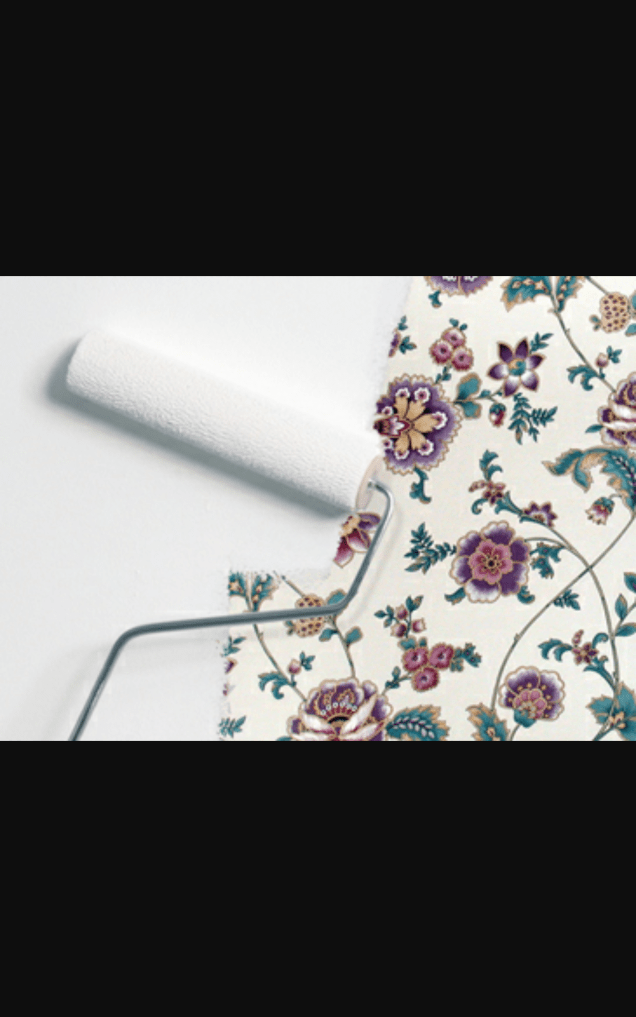

Single family home, 4 bedrooms, 3.5 baths. We called the listing agent the next day and set up a walk through at 4:30p.m. . The minute we saw it, viewing it with the light of our cell phones, we knew it was ‘The One’ for us. Even though, “Laura Ashley threw up in it.” a phrase I began to use to describe the house; as there was floral wallpaper and borders throughout. There was also blue countertops in the kitchen and bathrooms, and pink carpeting. There also was everything on our Wish List.

Suddenly, it occurred to us that our family was going to grow from a family of 4, to 6 with the children’s eventual spouses, to more once our future grandchildren arrive. Am I the only 52-year old that relishes the idea of my future grandchildren? I don’t want to rush things; as my children are 19 and 21; but, I’d be lying if I didn’t admit that I look forward to those days. So, it began, our incredible journey to selling the home we loved for 22 years and taking on the challenge of a new project.

As we began on our adventure transforming the house where ‘Laura Ashley threw-up’; we decided we needed a professional’s opinion. Not that kind of professional; although it might be a good idea; anyone know of a good doctor? We called in a Handyman, a Wallpaper-Paint Pro.

As we began on our adventure transforming the house where ‘Laura Ashley threw-up’; we decided we needed a professional’s opinion. Not that kind of professional; although it might be a good idea; anyone know of a good doctor? We called in a Handyman, a Wallpaper-Paint Pro.